What is the 40 30 20 10 rule for money?

The most common way to use the 40-30-20-10 rule is to assign 40% of your income — after taxes — to necessities such as food and housing, 30% to discretionary spending, 20% to savings or paying off debt and 10% to charitable giving or meeting financial goals.

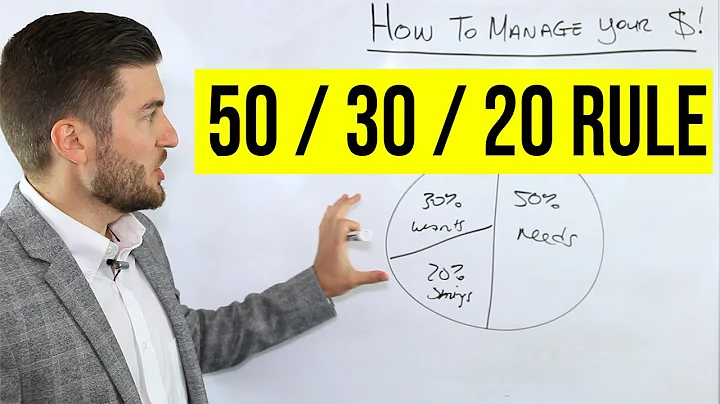

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

The 40-30-20-10 rule is a guideline for budgeting, not a strict rule. It emphasises allocating income towards necessities, discretionary spending, savings, and charitable contributions. Real-life application might require adjustments based on individual financial situations.

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

Are you approaching 30? How much money do you have saved? According to CNN Money, someone between the ages of 25 and 30, who makes around $40,000 a year, should have at least $4,000 saved.

The 20/10 rule follows the logic that no more than 20% of your annual net income should be spent on consumer debt and no more than 10% of your monthly net income should be used to pay debt repayments.

The rule requires that you divide after-tax income into two categories: savings and everything else. So long as 20% of your income is used to pay yourself first, you're free to spend the remaining 80% on needs and wants. That's it. No expense categories.

The 80/20 rule says that you should first set aside 20% of your net income for saving and paying down debt. Then split up the additional 80% between needs and wants. When using the 80/20 rule, calculate the amounts based on your net income - everything leftover after you pay taxes.

Put 60% of your income towards your needs (including debts), 20% towards your wants, and 20% towards your savings. Once you've been able to pay down your debt, consider revising your budget to put that extra 10% towards savings.

What is the 80 10 10 budget?

When following the 10-10-80 rule, you take your income and divide it into three parts: 10% goes into your savings, and the other 10% is given away, either as charitable donations or to help others. The remaining 80% is yours to live on, and you can spend it on bills, groceries, Netflix subscriptions, etc.

The 90-10 rule says that 90% of your refund will go toward financial progress like paying down debt, saving or investing. The other 10% is fluff money. Do what you want with it with zero guilt or regret.

What is the 60/40 rule? The 60/40 portfolio is a simple investment strategy that allocates 60 percent of your holdings to stocks and 40 percent to bonds. It's sometimes referred to as a “balanced portfolio.”

The 40–40–20 budget rule is a simple yet powerful guideline that allocates income into three distinct categories: 40% for necessities, 40% for savings and debt repayment, and 20% for discretionary spending.

One method that stands out for its simplicity and effectiveness is the 60-20-20 rule. This approach involves dividing your post-tax income into three categories: 60% for necessities, 20% for savings, and 20% for wants.

20% for savings. 20% for consumer debt. 60% for living expenses.

When your savings reaches $100,000, that's a milestone worth marking. In a world where 57% of Americans can't cover an unexpected $1,000 expense, having a six-figure savings account is commendable.

After analyzing many scenarios, we found that 75% is a good starting point to consider for your income replacement rate. This means that if you make $100,000 shortly before retirement, you can start to plan using the ballpark expectation that you'll need about $75,000 a year to live on in retirement.

If you're looking for a ballpark figure, Taylor Kovar, certified financial planner and CEO of Kovar Wealth Management says, “By age 30, a good rule of thumb is to aim to have saved the equivalent of your annual salary. Let's say you're earning $50,000 a year. By 30, it would be beneficial to have $50,000 saved.

The Rule of 69 is used to estimate the amount of time it will take for an investment to double, assuming continuously compounded interest. The calculation is to divide 69 by the rate of return for an investment and then add 0.35 to the result.

What are the 5 C's of credit?

The five Cs of credit are important because lenders use these factors to determine whether to approve you for a financial product. Lenders also use these five Cs—character, capacity, capital, collateral, and conditions—to set your loan rates and loan terms.

The factors that determine your credit score are called The Three C's of Credit – Character, Capital and Capacity.

The zero-based budgeting process is a strategic budgeting approach that mandates a fresh evaluation of all expenses during each budgeting cycle. Unlike traditional budgeting, where previous spending levels are typically adjusted, ZBB requires individuals or organizations to justify every expense from the ground up.

Key Takeaways

With the 80/20 rule of thumb for budgeting, you put 20% of your take-home pay into savings. The remaining 80% is for spending. It's a simplified version of the 50/30/20 rule of thumb, which allocates 50% of your take-home pay to needs, 30% to wants, and 20% to saving.

Key Takeaways. The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

References

- https://www.sofi.com/learn/content/70-20-10-rule/

- https://www.ramseysolutions.com/budgeting/how-to-make-a-zero-based-budget

- https://www.chase.com/personal/banking/education/budgeting-saving/how-much-income-should-go-to-rent

- https://www.bankrate.com/investing/what-is-the-rule-of-72/

- https://www.range.com/blog/pay-yourself-first-following-the-80-20-budget

- https://702010institute.com/702010-model/

- https://moneytalkwitht.com/blog/how-to-turn-10k-into-100k/

- https://www.houzeo.com/blog/pros-and-cons-of-flipping-houses/

- https://www.investopedia.com/ask/answers/051815/how-can-i-use-rule-70-estimate-countrys-gdp-growth.asp

- https://www.fnbo.com/insights/personal-finance/pay-yourself-first

- https://www.thebalancemoney.com/what-is-the-rule-of-70-5198230

- http://www.nfitfiji.com/personal-finances/the-three-cs-of-credit/

- https://medium.com/@how2market/what-is-the-40-40-20-budget-rule-dae5881ac74f

- https://finance.yahoo.com/news/live-1-000-per-month-200011859.html

- https://medium.com/@dontworkanotherday/how-to-double-2000-in-24-hours-9-easy-methods-dc9ee24571fb

- https://www.experian.com/blogs/ask-experian/what-is-70-percent-rule-for-retirement-savings/

- https://www.quora.com/Is-4000-per-month-good-in-California-Los-Angeles-for-single-man-or-not-if-not-how-much-the-minimum-salary-for-living-in-Los-Angeles

- https://barbarafriedbergpersonalfinance.com/penny-doubled-for-30-days/

- https://fastercapital.com/content/Exponential-growth--Understanding-Exponential-Growth-with-the-Rule-of-70.html

- https://money.usnews.com/money/personal-finance/spending/articles/how-the-70-20-10-budget-rule-works

- https://finance.yahoo.com/news/why-50-30-20-budget-120032412.html

- https://www.5paisa.com/stock-market-guide/generic/rule-of-72

- https://cozinhacabral.com/20-10-rule-to-calculate-debt-limits/

- https://www.dnaindia.com/personal-finance/report-502525-savings-rule-a-simple-budgeting-strategy-for-financial-success-3031524

- https://homework.study.com/explanation/how-long-would-it-take-1-000-to-double-if-it-were-invested-in-a-bank-that-pays-6-per-year.html

- https://en.wikipedia.org/wiki/Golden_Rule_(fiscal_policy)

- https://www.quora.com/Is-a-50-increase-the-same-as-doubling

- https://www.livemint.com/money/personal-finance/what-is-the-100-age-rule-of-asset-allocation-mintgenie-explains-11704719222344.html

- https://corporatefinanceinstitute.com/resources/wealth-management/rule-of-70/

- https://www.thestreet.com/retirement-daily/your-money/the-rule-of-three

- https://www.investopedia.com/articles/investing/093015/why-saving-10-isnt-enough-get-you-through-retirement.asp

- https://quizlet.com/594491727/personal-finance-saving-33-flash-cards/

- https://traderlion.com/quick-reads/penny-doubled-for-30-days/

- https://www.nasdaq.com/articles/5-things-you-shouldnt-do-when-your-savings-reaches-$100000

- https://www.vsecu.com/blog/the-power-of-seven-a-complete-guide-to-the-seven-percent-savings-rule/

- https://www.bankrate.com/investing/the-60-40-portfolio-is-back-but-did-it-ever-really-leave/

- https://www.moneycontrol.com/news/mcminis/personal-finance/how-long-does-it-take-to-double-your-money-8156861.html

- https://www.purdue.edu/hr/CHL/healthyboiler/news/newsletter/2021-05/retirement-savings.php

- https://www.linkedin.com/pulse/mastering-your-finances-budgeting-60000-salary-60-20-20-zain-timimi-r0ojc

- https://finance.yahoo.com/news/grant-cardone-swears-40-40-110053843.html

- https://homework.study.com/explanation/did-albert-einstein-invent-the-rule-of-72.html

- https://www.linkedin.com/pulse/did-einstein-invent-rule-72-peter-frampton

- https://www.cnbc.com/select/rule-of-72-what-it-is-how-to-calculate-it/

- https://www.cnbc.com/select/how-much-money-you-should-save-every-paycheck/

- https://www.otffeo.on.ca/en/wp-content/uploads/sites/2/2013/09/OTF_secondary_rule_72_activity.pdf

- https://www.linkedin.com/pulse/what-1000-a-month-rule-retirement-tpaee

- https://finance.yahoo.com/news/40-30-20-10-rule-132128106.html

- https://trb.bank/personal-finance/what-is-the-10-savings-rule/

- https://www.forbes.com/advisor/banking/budget-calculator/

- https://www.nsta.org/science-teacher/science-teacher-julyaugust-2020/exponential-growth-and-doubling-time

- https://www.wsj.com/buyside/personal-finance/how-much-do-i-need-to-retire-f3275fa7

- https://beyondyourhammock.com/rules-of-personal-finance/

- https://www.beachhousewealth.com/article-the-20-20-60-rule

- https://www.bankrate.com/real-estate/70-percent-rule-house-flipping/

- https://www.spaceship.com.au/learn/what-is-the-rule-of-72/

- https://www.investopedia.com/terms/f/five-c-credit.asp

- https://www.primerica.com/public/rule-of-72.html

- https://localfirstbank.com/article/how-much-money-should-i-have-saved-by-the-time-i-am-30/

- https://m.economictimes.com/wealth/plan/what-is-the-50-30-20-rule-in-financial-planning/articleshow/104599892.cms

- https://www.linkedin.com/pulse/pros-cons-503020-budgeting-rule-hunter-coleman

- https://investmentinsight0.quora.com/If-your-income-is-Rs-10-000-how-do-you-spend-it-monthly-and-how-do-you-save?top_ans=27100805

- https://n26.com/en-eu/blog/50-30-20-rule

- https://www.investopedia.com/ask/answers/what-is-the-rule-72/

- https://www.livemint.com/money/personal-finance/how-fast-can-you-double-your-money-with-ppf-mutual-funds-bank-fixed-deposits-rule-of-72-explains-11695454734074.html

- https://www.myhubble.money/blog/the-40-30-20-10-rule-to-saving-and-spending-money

- https://www.forbes.com/advisor/banking/savings/how-much-should-i-have-saved-by-30/

- https://www.cnbc.com/2020/01/28/what-the-rule-of-72-is-and-how-it-works.html

- https://finance.yahoo.com/news/gen-z-much-savings-25-193422711.html

- https://smartasset.com/investing/what-is-the-rule-of-72

- https://www.ibm.com/blog/what-is-zero-based-budgeting/

- https://m.economictimes.com/wealth/save/want-to-save-money-follow-this-50/30/20-rule/follow-this-simple-money-rule/slideshow/105013039.cms

- https://www.fool.com/the-ascent/banks/articles/is-10000-too-much-to-keep-in-a-savings-account/

- https://www.embers.org/calculator/rule-of-72-by-years

- https://www.nasdaq.com/articles/the-10-10-80-rule:-is-this-savings-system-best-for-you

- https://www.snagajob.com/salary-calculator?pay=5000&period=month

- https://www.fool.com/the-ascent/research/average-savings-account-balance/

- https://fiscalfitnessphx.com/follow-the-90-10-rule-when-it-comes-to-your-tax-refund/

- https://passiv.com/blog/how-to-the-rule-of-70/

- https://money.usnews.com/investing/articles/the-rule-of-72

- https://www.menshealth.com/fitness/a44765117/12-3-30-workout/

- https://www.troweprice.com/personal-investing/resources/insights/how-to-determine-amount-of-income-you-will-need-at-retirement.html

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://www.bankrate.com/banking/savings/30-day-savings-rule/

- https://www.opploans.com/oppu/financial-literacy/80-20-budget/

- https://www.linkedin.com/pulse/4-3-2-1-approach-financial-freedom-royston-tan-%E9%99%88%E9%9F%A6%E9%BE%99-chfc-asep-ibfa-

- https://www.realized1031.com/blog/what-is-the-rule-of-69-percent-in-real-estate-investing

- https://banzai.org/wellness/resources/rule-of-72-calculator-by-years

- https://www.quora.com/Why-does-the-rule-of-70-use-the-number-70-Why-couldnt-it-use-any-other-number-Eg-50-40-72-etc

- https://www.gobankingrates.com/money/making-money/best-ways-to-double-5000-dollars/

- https://www.thebalancemoney.com/dont-like-tracking-expenses-try-the-80-20-budget-453602

- https://www.education.ne.gov/wp-content/uploads/2017/07/Mindi-Reardon_Genoa-Twin-River-HS_Who-Wants-To-Be-Millionair-Lesson-Plan.pdf

- https://www.citizensbank.com/learning/50-30-20-budget.aspx

- https://myhubble.money/blog/the-40-30-20-10-rule-to-saving-and-spending-money

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.jsb.bank/resources/how-to-create-a-budget

- https://www.ovlg.com/blog/can-you-live-on-3000-a-month.html

- https://www.thestreet.com/investing/rule-of-72-14826842

- https://www.kaveshlaw.com/blog/claiming-social-security-benefits-at-age-70.cfm

- https://www.accountingtools.com/articles/rule-of-69

- https://money.usnews.com/money/retirement/articles/what-is-the-25x-rule-for-retirement-saving

- https://www.bankrate.com/retirement/what-is-the-4-percent-rule/

- https://www.forbes.com/advisor/banking/guide-to-50-30-20-budget/

- https://www.investopedia.com/terms/r/ruleof72.asp

- https://www.saponelaw.com/blog/2022/03/what-is-illegal-property-flipping/